In 2010, I submitted an idea to Google’s “Project 10^100“. It was about a novel approach to assess companies by factoring in their environmental and societal contributions. This new index – which I called “ETIX” – could have complemented traditional stock indices, providing a moral compass for socially responsible investments. (ETIX came from “Ethical Investment indeX.) Nevertheless, during that era, artificial intelligence was still in its early stages, and few believed it had the potential to eventually conduct such assessments seriously. Since then, AI has demonstrated its capability to undertake such complex tasks, and hopefully, the time is here to advance further with this idea.

What’s wrong with the market economy?

Traditionally, ambition and self-interest have been the main drivers of human progress. Although they have propelled advancements in various areas, they often result in shortsighted decisions, causing issues like social injustice, environmental exploitation, harm to third parties, and neglect of future consequences.

The free market economy’s assumptions, such as information availability and rational choices, have been proven false. In today’s world, information can be manipulated, and not everyone has equal access to it, which leads to suboptimal investment and consumption decisions and an ever-widening wealth gap. Behavioral economics has debunked the other core idea of the free market – that consumers make rational decisions – revealing how much emotions, biases, and social factors influence our choices.

The human brain’s capacity is limited to process and verify all available information to make well-informed decisions. Our consumer choices often do not align with our own interests, let alone humanity’s.

These inherent flaws underscore the need for a new fundamental value for the economy to guide human development toward a more sustainable and equitable path.

Working model

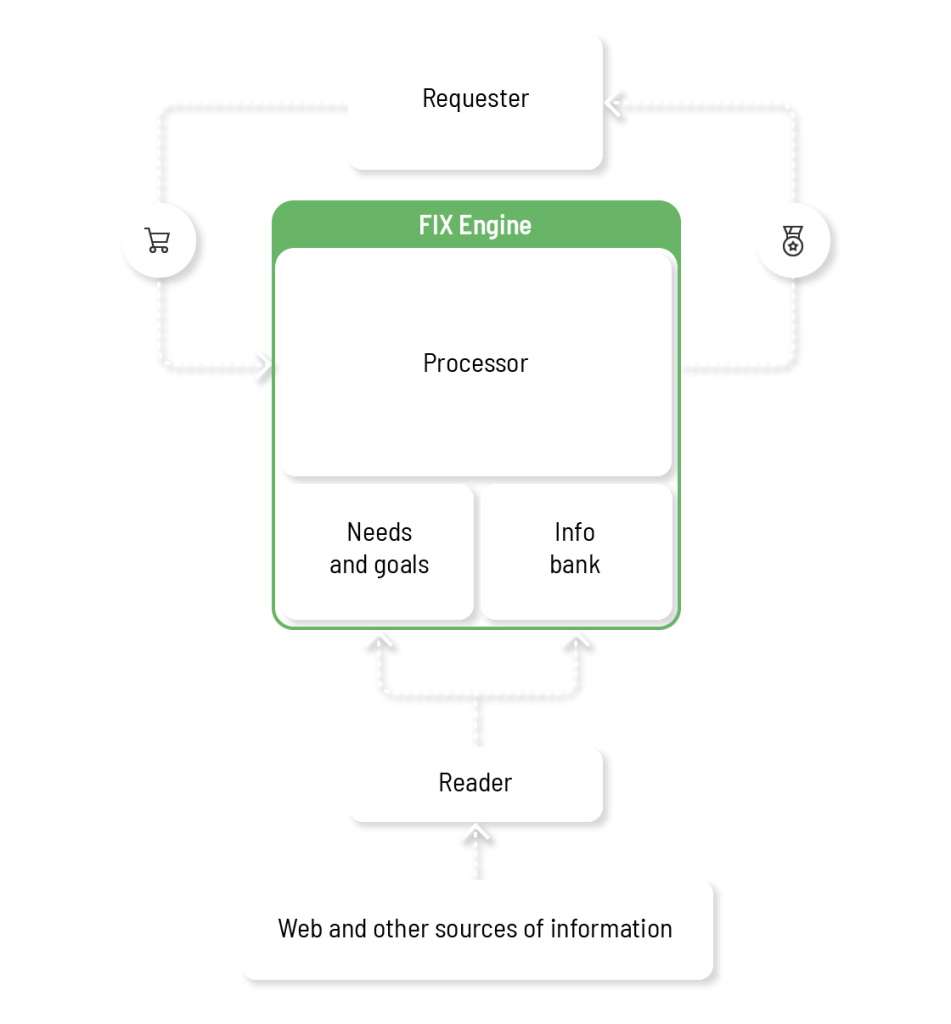

Since 2010, the concept has evolved from a numerical stock index into an API capable of assessing the environmental and societal impact of any “cart” – a stock, a company, or a product – and returning an overall “goodness” value. For simplicity, I’ll call the result of this assessment “FIX” – Future IndeX, while the application that does the evaluation is “Fix Engine.”

It operates as a web service where the requester assembles a shopping cart, providing as much detail as possible, including anonymous shipment information. The application then processes the cart and generates the FIX value, accompanied by detailed partial results and explanations.

This application is designed to function within a black-box model: the engine does not know the requester, focusing solely on assessment. This not only addresses privacy concerns but also guarantees impartiality. Most code should be open-source to establish trust and ensure its resilience against manipulation.

How can we train AI to align with our goals?

To start, we must ascertain the fundamental needs of humanity and the Earth to ensure a sustainable and fulfilling life.

As a starting point, we could consider utilizing a framework such as Maslow’s Hierarchy of Human Needs or a modified version as proposed in this article.

Subsequently, the AI could conduct interviews to refine the prioritization of these needs and extend its understanding to encompass the requirements of other living beings and account for the needs of future generations. Based on this information, it could assess industrial processes and products. The needs map and evaluations should remain flexible, allowing immediate modifications in response to any newly emerging information.

A few potential applications

- Tracking personal finances with the help of a mobile app.

- Offer insights with payment solutions like Google Wallet, PayPal or Stripe

- Offer guidance for customers before making a purchase.

- Shops can provide environmental feedback alongside prices on price charts.

- Banks could offer ‘Green’ cards that provide feedback on the cardholder’s spending. They can also reward future-proof spending.

- Banks can offer responsible investment packages.

- Stock markets can give sustainability information.

- Directing government or EU funding toward a sustainable economy.

Development roadmap

- Building a minimum viable product (MVP), demonstrating the concept’s viability for a few products in a particular category. We don’t have to make exact assessments. The goal is to be able to compare products. Whatever that’s better than nothing is okay. Just like in the early ages of internet search, when Google could take over the whole search market with such an oversimplified assumption that “the more links point to a page, the more valuable it is”.

- Expanding the database with grocery store products. At this stage, a simple mobile app could utilize the FIX engine and provide feedback on people’s spending habits.

- Expanding the database to include more significant investments – stocks, savings, cars, entertainment, and travel – allows financial institutions to offer more serious uses.

- Ideally, in a few years, the engine could become smart enough to help evaluate tenders and assess a complete country or campaign programs of parties running in an election.

Business model

In a profit-driven world, it is essential to generate revenue, even for a product that aims to revolutionize the entire model. Here are some potential revenue-generation strategies:

- Charging financial institutions and payment providers a service fee.

- Implementing a subscription fee for the mobile app.

- Providing an opt-in user-guidance system for companies that attain a specific FIX level for a minimal fee.

- Providing sustainability assessment services for governments for a fee.

- Accepting funding from the EU, non-profit organizations, or global entities.

- Exploring a sustainability compensation program, provided corruption risks can be managed.

Possible threats and antagonists

While adopting this model could bring overall benefits to humanity, not everybody will win on this in the short run. It is imperative to raise awareness that persisting with the status quo will ultimately jeopardize the future for all of us. We need to be prepared to respond to critiques from certain interest groups:

- Greenwashing Organizations: They may seek to undermine the accuracy and impartiality of the AI assessment. Answer: We offer an open testing environment to demonstrate the engine’s neutrality. Additionally, the fact the engine is open-source should build trust.

- Energy and Mining Industry: They could assert that moving away from non-renewable energy might harm the economy. Answer: Disproving their claims is straightforward, yet it’s important not to underestimate their influence through lobbying.

- Governments: Some governments may prioritize short-term national interests over global and long-term benefits. Answer: In a time when immediate action is imperative, accommodating the interests of every country’s government becomes unfeasible. Political systems need to evolve, and voting methods need to adapt; AI might someday contribute to these changes.

- Privacy Advocates: Concerns may be raised about collecting extensive personal data. Answer: No personal data will be collected due to the black box model.

- Public: Concerns about the potential for “Green dictatorships”, wherein governments might wield their authority through this assessment. Answer: The same as above.

- Free Market Advocates: Those advocating for free market principles may express reservations about potential interference with established rules, often aligned with large corporations or investment funds. Answer: We should develop educational materials and gather comprehensive statistics regarding the potential impact of FIX.

- Large Corporations: Companies adapting to sustainability-driven regulations might experience profit loss, motivating efforts to discredit the API in response. Answer: Companies have traditionally been shaped by profit-driven economies, but they have the potential to adapt and align with investors’ new expectations by incorporating FIX assessment alongside traditional Stock Index evaluations.

It should be clear that the danger of maintaining the existing status quo outweighs the validity of these justifications. In any case, I expect the next decade to be worrying for humanity, whether we succeed in implementing a better economic governing principle or not.

It’s still not too late to change the course of late capitalism, but every year we spend doing nothing will be sorely missed in the future. Now is the time to act.